Overall, the Australian labour market is still underperforming. Employment growth has fallen below the peaks of 2014 and 2015 and is still well below recent growth benchmarks. There are some areas of “better” performance as of the March 2017 data, but two points put into question whether we are on the path to an improved labour market. First, despite the more recent pickup in employment growth, the current increase in participation is leading to an increase in the number of unemployed persons. While there is a reason to give this the benefit of the doubt, it does appear that employment growth is not high enough to absorb those workers returning to the labour force. Secondly, the welcomed and positive shift to greater growth in full-time employed persons has not been confirmed by the growth in full-time hours worked. Growth in aggregate hours worked has slowed throughout the March quarter.

The top-line seasonally adjusted number was strong – employment grew by +60k persons. This is the largest (seas adjusted) monthly increase since October 2015. I always look at the trend data though, and that was good for the month too. The annual seasonal reanalysis was completed in February, so this changed the ‘shape’ of many trends between the February and March data, but at least our benchmark for 2017 has been set.

Labour market is still underperforming…

Across different measures and benchmarks, the Australian labour market continues to underperform.

First, the trend in the annual growth highlights just how much the growth in employed persons has slowed in the space of the last year.

In March 2016, the total number of employed persons grew by 250k persons (annual) – in March 2017, that growth has slowed to +122k persons. Total unemployed persons are increasing again as more people come back into the labour market:-

Source: ABS

On the positive side, the annual growth in total employed persons has started to improve over the last 3 months. More on this shortly.

Second, annual growth in employed persons is sitting well below the 10-year average benchmark.

The 10 year average measures the average annual growth (in 000’s persons) for March over the last 10 years. The current annual rate of growth in employed persons (at March 2017) is +122k persons versus the average over the last 10 years of +189k.

Source: ABS

This is much worse when you break out full-time (FT) numbers. Annual growth in FT employed persons was a mere +25k persons versus the 10 year average of +102k persons. On the flipside, part-time (PT) employment growth is performing just above the 10-year average, +97k annual growth in PT employed persons versus +86k for the 10-year average. The current annual growth in total unemployed persons is now above the 10-year average – which is not a good thing.

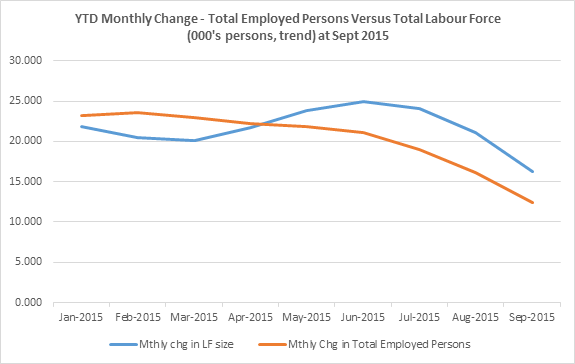

Third, the current growth in the number of employed persons is below that of the labour force.

Comparing the gap between the growth in employment and growth in the total labour force is an interesting way to gauge the ‘strength’ of employment growth. The result of employment growing slower than the labour force is an increase in the number of unemployed persons.

Source: ABS

For most of 2015 and the first half of 2016, employment grew by a greater number than the labour force and unemployment fell as a result. The (now negative) gap between employment and labour force growth since Sept 2016 is not the widest it has ever been, but it does mark a shift to a more negative trend.

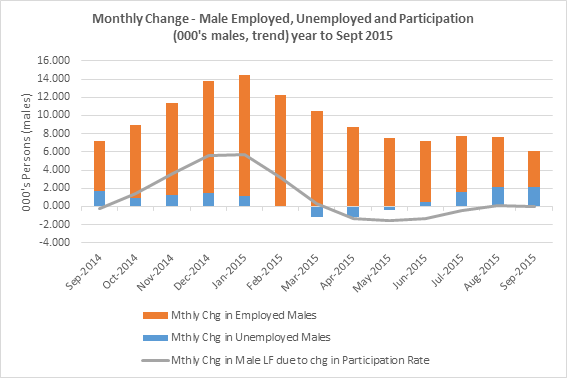

One way to view changes in the labour force size is by looking at what population growth adds and the impact +/- of changes in the participation rate. Over the last four (4) months there has been a shift to people coming back into the labour force and it’s this increase in participation that has contributed to the growth in the labour force:-

Source: ABS, The Macroeconomic Project

The exact reason why people are coming back (or left in the first place) into the labour force cannot be answered by this data.

Comparing employment growth to LF growth suggests that employment is not growing fast enough to ‘absorb’ those people coming back into the labour market. It could be a timing issue. Participation has been increasing over the last four months and the current median duration of job search in Australia is 12 weeks (unchanged from a year ago) so it might take a few more months of data to gauge whether unemployment continues to accelerate. But the fact that the median duration of job search hasn’t changed suggests that there hasn’t been much, if any, tightening in the labour market -the same median job search duration suggests that it is neither easier nor harder to find a job overall.

Finally, while employment growth has improved recently, the distribution of that growth among the states has not been broad based.

The annual growth in employed persons has been concentrated in VIC. The problem is that some of the states that had previously been bigger drivers of employment growth (NSW, QLD and WA) have completely underperformed versus the 10-year average:-

Source: ABS

Smaller states have performed better with regard to employment growth – NT, TAS, ACT and SA all performed above the 10yr average but most of that growth has been PT employment (which is still better than no growth).

Are we on the path to a better labour market performance? Have we turned the corner?

There is some evidence of more positive shifts in the labour market performance, but it is mixed.

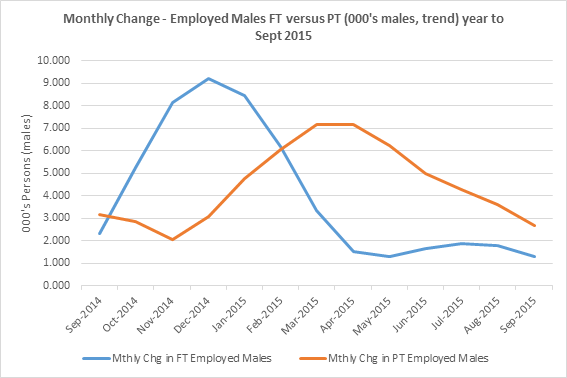

A better sign is that on a National level, one of the more negative trends in the labour market appears to have reversed in the last five months. Full-time employment is now growing faster than part-time. I say this has been a negative trend because the underemployment ratio at an all-time high suggests that many are turning to PT work out of necessity and actually want more hours of work.

Over the last five months, FT employed persons has grown faster than PT. Below is the monthly change over the last two years:-

Source: ABS

But again, the distribution of this growth in FT employment, especially in this latest quarter is limited. Only two states have contributed to the bulk of this growth in FT jobs – VIC and WA.

Across the states in the latest quarter:-

- NSW – PT job losses are driving the overall decline in employment for the quarter and FT employment growth has not been high enough to offset this decline. FT employ growth +3.7k persons and PT employed persons -8.6k

- VIC – FT employment growth +14.1k persons and PT employed persons +1.8k

- QLD – growth in PT employment has exceeded FT growth in the last 3 months but the trend for FT employment growth is looking positive. Growth in FT employed persons +3k and +10k PT employed persons

- SA – growth in PT employment has exceeded FT and the trend has become more negative over the last few months. Growth in FT employed persons +0.3k and growth in PT employed persons +3.1k

- WA – accounted for the largest growth in FT employment across all states – growth in FT employed persons +14.9k offsetting a decline in PT employed persons of -8.2k

- TAS – an overall positive performance with +0.4k FT employment growth and +0.6k PT employment growth

- NT – growth in FT employed persons +1.8k and +1.6k PT employed persons

- ACT – growth in PT employment is just offsetting the decline in FT employment in the latest quarter. FT employed persons -1.2k and +1.3k PT employed persons

The turnaround in employment growth in QLD and WA is notable and NT continues to punch above its weight in the latest quarter. This is to be expected to a certain degree given the rebound in our main export commodity prices. But given these levels of employment growth, only in WA, TAS and NT has unemployment declined in the latest quarter.

While it is a better sign that FT employment has grown (increased income), PT employment growth has unfortunately been slowing and this has impacted overall employment growth in the last few months – the total growth each month (FT+PT) is still well below that of the peaks of 2014 and 2015.

Despite the shift to greater FT versus PT employment growth, the underemployment ratio has continued to rise:-

Source: ABS

In other words, a growing proportion of employed persons (9.1%) wants and is available for more hours. This is an important sign of how much slack still exists in the labour force and possibly how households might be coming under greater income pressure.

There is also a question mark over the rate of growth in FT employed persons – there has been a divergence between the growth in FT employed persons and the growth in FT hours worked over the last few months.

There has been growth in the number of FT employed persons yet FT hours worked have been slowing and then declining month on month over the last four months:-

Source: ABS

It creates some doubt over which measure is the more accurate representation of the labour market – FT employment growth or FT hours worked?

Seeing hours worked grow faster than employed persons is easier to explain i.e as demand increases, it’s easier/faster/lower risk for firms to extend overtime hours of existing employees rather than expand the workforce, which takes longer. But it’s more difficult to see how we can be adding more FT employed persons, yet FT hours worked are declining. It doesn’t seem to be simply a timing issue – past data shows that the timing of the two measures is fairly consistent, with both measures turning at a similar time. In the chart above, the divergence has been occurring for most of the last half of 2016 and 2017 YTD.

No such divergence exists between the growth in PT employed persons and the monthly decline in PT hours worked:-

Source: ABS

Growth in PT employed persons and PT hours worked have slowed throughout the last half of 2016 to zero growth as of March.

Either way, there is a concerning trend that aggregate hours worked in the economy slowed throughout the March quarter.

Across most measures, the labour market is still underperforming. Employment growth is low, unemployment is increasing, under-employment is still increasing and hours worked is slowing.