There are four key themes in our business and economic news at the moment. In no particular order;

- The state of manufacturing in Australia

- The shift from the mining investment boom to the mining export boom

- Impact of the strong $A on Aussie business, especially manufacturing, exports and retail

-

The housing market

Are these issues receiving a disproportionate amount of airtime? To what degree is our economic performance really tied to these industries? Frequent and emotionally charged media coverage can influence our perception of just how big some issues really are. So it’s time for some context.

I thought that it would be helpful to post the breakdown of employment & output by industry in Australia to understand the relative size and importance of each sector.

Whether you look at these issues through the lens of employment or output, industries such as manufacturing, mining, retail and housing are important to our economic wellbeing. There are a few surprises too.

Employment by Industry

These first two charts look at total employment by industry (in actual 000’s of persons) and how much that employment has changed over the last year (growth/decline in 000’s of persons).

Source: ABS, 6291 – latest data is Feb 2013

Change in Employment by Industry

Source: ABS, 6291 – latest data is Feb 2013.

Source: ABS, 6291 – latest data is Feb 2013.

The employment figures have moved a lot over the last three months, but this data will give a good sense of the relative size of employment by industry.

Top five (5) Australian industries by employment; Health Care, Retail Trade, Construction, Manufacturing and Education.

Health Care & Social Assistance – our largest industry by employment size, it accounts for 12% of total employed and was one of the largest gainers in total employed over the last year with +35k persons growth. From an output perspective, it represents approx. 6% of output (gross value added or GVA). Output growth in the sector has also been well above real GDP growth +6.5% (second fastest growth industry behind mining).

Retail Trade – accounts for 10% of total employed, with growth of +12k persons over the last year. From an output perspective, retail trade accounts for a smaller 4% of total GVA/output. Growth in output is just above growth of real GDP at +3.5%. From an aggregate perspective, this isn’t a bad result. Given the issues facing retail and the performance of key retailers, I fully expected to see both employment & output share declining. It’s possible that one or two states could still be keeping the aggregate numbers higher. This will be the focus of another post.

Construction – accounts for approx. 7.3% of total employed and employment in this industry is still growing year on year by +11k persons. The red flag is output – construction is the 4th largest industry by output/GVA and output is growing well below real GDP at +1.4%. This is possibly a sign of the times with mining investment, & investment generally, slowing down and reduced public sector investment spending.

Manufacturing – The exception to the employment growth story was manufacturing. Currently the 4th largest industry by employment, manufacturing employment declined year on year at Feb ’13. The decline in manufacturing employment appears much smaller than I would have expected on a year on year basis (-3k persons), given the seemingly constant reports in the media and the poor Performance of Manufacturing Industry (PMI) reports. The most recent PMI reports do point to an improvement in manufacturing – potentially linked to a lower Australian dollar.

Over the last ten years, the number of persons employed in manufacturing as at February has averaged 1.024m. As at Feb 2013, employment in this sector is at 954k, or -7% below the ten year average. Total employed in manufacturing as a share of total employed persons in Australia has consistently declined since the early 80’s;

Source: ABS

Source: ABS

The decline in manufacturing employment share of total employment is not a recent thing (see chart above). This means growth in manufacturing jobs has not kept pace with total employment growth during this entire period. This is evident when you look at the raw numbers of persons employed in manufacturing;

Source: ABS

Source: ABS

Between 1984 and the end of 2007 total employed in manufacturing bounced around above one (1) million in a reasonably consistent manner. From the end of 2007 we start to see a pronounced declined in actual total persons employed in manufacturing.

It’s hard to have one blanket reason why employment in manufacturing is falling in Australia –lack of competitiveness (including dollar movements), greater automation of previously labour intensive tasks and/or lower demand (especially post GFC). But even now at 8% of people employed in Australia, manufacturing is still a very important industry. From an output perspective, manufacturing is our 5th largest industry, accounting for 7% of total GVA/output. But that output declined year on year by -1.4%. Similarly, the share of manufacturing output to total GDP has more than halved since 1974. As a share of exports, manufacturing represents approx. 10% (year to Mar ’13, chain vol, seas adjusted), so again, a reasonably significant amount.

Education – is the 5th largest industry by total employment, employing just over 900k persons. It’s also been one of the fastest growing in terms of employment growth with +43k persons employed over the last year. From an output perspective, education accounts for approx. 4% of total output/GVA, but growth has been well below real GDP growth at +2%. This is potentially a red flag for future employment in the industry.

Employment has grown on an annual basis in all of the top five industries except manufacturing. From recent posts on employment, we also know that PT employment is growing faster than FT and it’s likely that service-based industries such as retail trade, education and health care could be driving this growth in PT jobs.

What the top 5 industries look like in terms of share of total employment;

Source: ABS

Source: ABS

The decline in manufacturing share of employment is clear. The two most significant gainers in employment growth have been in the Construction and Health Care industries.

What’s missing in this list is mining. Whilst the data suggests it’s a small proportion of total employed (2.2%) there are two things to consider. One is that mining is relatively concentrated in two/three key states – WA, QLD & NT. Secondly, the total numbers quoted here under ‘mining’ don’t take into consideration the impact on the support industries such as science, engineering, transport, construction etc. No doubt the mining investment boom has required greater value added resources from other sectors in the economy. As the shift moves from investment to export focus there is likely to be an impact (negative) on employment and wages.

Output by Industry – Share of Real GDP

This set of charts looks at Australian industries by their share of real GDP and their growth in output (as measured by Gross Value Added). This will provide a sense of just how important some industries are to the total output of our economy. When combined with the employment data, we can ascertain the importance by output and employment.

Source: ABS

Source: ABS

Change in Output by Industry

Source: ABS

Source: ABS

The top five (5) Australian industries by output – as measured by share of real GDP – mining (adding exploration & support services), financial services, ownership of dwellings, construction and manufacturing. These top five industries accounted for a whopping 41% of total real GDP over the last year.

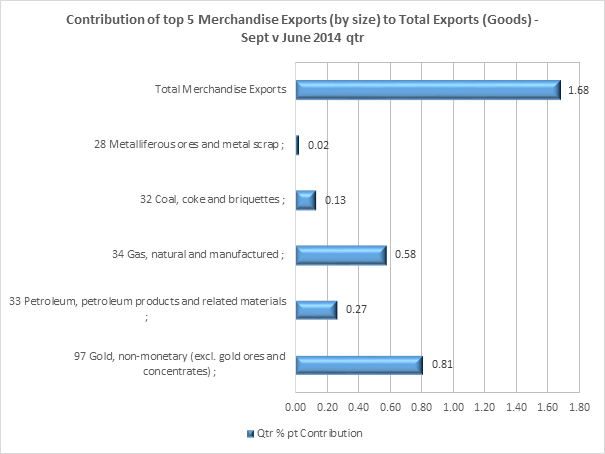

Mining – is our number one industry with 10% share of real GDP. A recent RBA paper on the Industry Dimensions of the Resources Boom suggests that mining share of output is closer to 18% when the value added of industries that provide inputs to resource extraction and investment, such as business services, construction, transport and manufacturing are included. Output growth is the highest of all industries with growth of 9% (when mining is combined with exploration – exploration is only approx. 0.8% of output). From an export perspective, mining (metal ores & minerals, coal, coke & briquettes, other mineral fuels and metals ex non-monetary gold) represents 66% of total goods exports (for the year to Mar 2013, chain vol, seas adjusted). Despite accounting for such a large share of output and exports, share of employment is much lower at 2% (higher if you include support industries of course). Growth in employment was +6.5k persons over the last year, which still paints a reasonably rosy picture of the state of the mining industry. Most recent figures show a distinct uptick in unemployment in WA and indeed, the employment numbers point to a recent decline in total employed persons in mining;

Source: ABS

Source: ABS

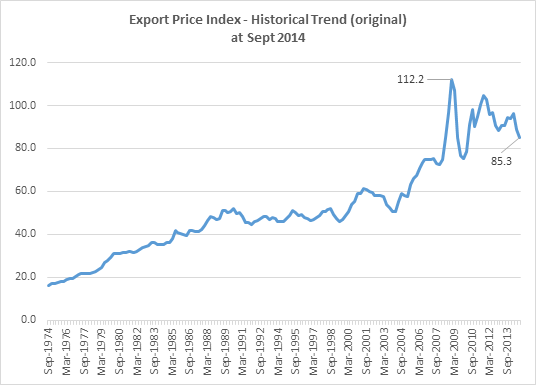

On the back of lower export prices, mining profits have been declining. Major infrastructure & new mining projects have also been cancelled. For the moment, export volumes remain strong although slower growth in the Chinese economy is expected to impact those exports in the future. As the shift moves towards export rather than investment, and in light of falling prices, the focus in the industry will be to minimize costs in order to boost profitability. All these factors could combine to result in slowing exports, reduced investment, lower salaries and less employment associated with mining. This is not a good outlook for our biggest industry by output and exports.

Financial Services – accounts for 9.6% of GVA and has been growing at well above real GDP at +4.3%. Despite that, employment has declined over the last year by -13k persons. The industry accounts for 3.5% of employed persons.

Ownership of dwellings – In the system of National Accounts “owner-occupiers of dwellings, like other owners of dwellings, are regarded as operating businesses that generate a gross operating surplus (GOS). The imputation of a rent to owner-occupied dwellings enables the services provided by dwellings to their owner-occupiers to be treated consistently with the marketed services provided by rented dwellings to their tenants. Owner-occupiers are regarded as receiving rents (from themselves as consumers), paying expenses, and making a net contribution to the value of production which accrues to them as owners. GOS for ownership of dwellings is derived as gross rent (both actual and imputed) less operating expenses (but before the deduction of consumption of fixed capital). An estimate of GOS for dwellings owned by sectors other than households is deducted to obtain GOS for dwellings owned by persons.” (Source: ABS)

So our ownership of dwellings accounted for 7.5% of National output and is growing at just below real GDP at 2.7%. Note that this imputed value doesn’t net out outstanding debt associated with those assets. Ownership of dwellings isn’t an industry that increases the productive capacity of the economy (of course, unless you are building new dwellings etc.) or drive productivity improvements. But it does give you an idea of just how big ownership of dwellings is in our economy. The Australian economy has become more and more reliant on trading established dwellings for greater and greater value, and all the while notching up greater and greater debt within the economy.

According the latest Census data (2011) 67% of households are owner-occupiers;

Source: ABS Census 2011

This is made up of 34.9% who ‘own’ with a mortgage and 32.1% who own their homes outright (for a total of 67%). In the 1996 Census, 66.4% of households were owner occupiers where 25.5% ‘owned’ with a mortgage and a much higher 40.9% owned their home outright. There has been a clear shift to more people owning with a mortgage = greater debt. This does not include any investment property data.

Construction – It’s one of our largest employers as well as one of our largest industries by size of output (see earlier comments). Share of total GVA hasn’t really changed all that much over the last 40 years. Construction has gone from 6.8% share of real GDP in 1974 to 7.2% share in Mar 2013, hitting a peak of 7.5% share in June qtr. 2011. The AIG Construction Outlook is for lower growth in construction. This is already playing out in the most recent output & employment data.

Manufacturing – although still a large proportion of our total output and employment, manufacturing in Australia has been declining in importance for many years, aided in part by the dismantling of various tariffs. If we can’t compete on the world stage (or even our own stage) without subsidies, then should we even be in that that industry? Couldn’t those resources currently tied up in manufacturing be used in more productive endeavours? For an interesting discussion on the importance of manufacturing, see full article here. It suggests that;

“Productivity is the key to national standards of living. Only through productivity growth do we sustainably increase our competitive advantage, capital formation, incomes and employment. Manufacturing accounts for a huge slice of productivity potential in all economies. Without it, any economy will struggle to generate long term high productivity growth. Mechanisation, improved processes, innovation and technical progress are the bread and butter of productivity growth. They simply do not exist to the same extent in services, nor, for the most part, in mining (though the runoff in the boom will be good for the next few years)” (source: www.macrobusiness.com.au)

From an export perspective, manufacturing represents just over 10% of goods exports (for the year to Mar 2013, chain vol, seas adjusted) – made up of machinery, transport equipment and other manufactures. This is only slightly down from its high of 14% in the June 08 qtr. As a share of total goods exports, manufacturing had grown steadily until the GFC. If share of local manufacturing has been declining, then it’s likely that locally made goods are being substituted for imports (for various reasons). Some of the hardest hit local manufactures have been in textiles & clothing;

Source: ABS

Source: ABS

Overall, our top five industries by output do in fact tie in with the central themes of manufacturing, mining and housing. Unfortunately, it’s not all positive. The decline in manufacturing share is prominent, but then so is the growth in share of mining & finance.

Source: ABS

Source: ABS

So there are at least three key industries in Australia that account for a high proportion of output, employment and/or exports – mining, construction and manufacturing. The outlook for these three sectors is not particularly positive;

- Our (re)new(ed) PM, Kevin Rudd has bravely claimed the end of the resources investment boom. What lies ahead for mining is unclear. Exports are forecast to remain strong, but that mostly hinges on what happens to Chinese demand.

- The RBA is looking to construction to fuel the next leg of growth in Australia. But where will that construction investment come from? Housing? Household mortgage debt is already high and this doesn’t improve the productive capacity of the economy anyway. Business? Well, mining investment appears to have peaked and non-mining investment has been flat and is forecast to decline slightly. Public? Public investment is unlikely in the face of government tightening, unless there is a major push behind a stimulus package.

- Manufacturing is the other major industry that accounts for a large share of output and employment. For the moment, it seems that as a country we are happy to continue to let this industry slide despite the potential productivity benefits that could be delivered.

Source: ABS

Source: ABS

Source: ABS

Source: ABS Source: ABS

Source: ABS